Jupiter’s Launchpad Mechanism Riles Up Crypto Community

Solana-based DEX Jupiter airdropped $700M worth of JUP tokens to early adopters this week.

By: Owen Fernau • Loading...

DeFi

After hundreds of millions of dollars worth of JUP tokens were distributed to early users of Jupiter, a DeFi project best known for its DEX aggregator, the team behind the project is being accused of using the hype to cash out.

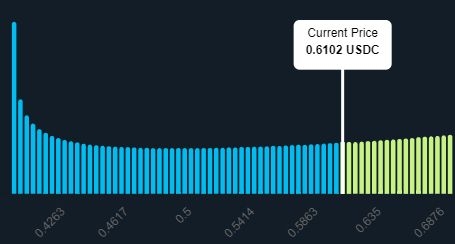

The controversy centers around a platform called LFG Launchpad, developed by Solana-based Jupiter, which is facilitating the sale of JUP tokens. The Jupiter team seeded the launch pool with 250M JUP tokens – roughly 18.5% of the 1.35B tokens currently in circulation and 2.5% of the 10B total JUP supply.

Currently, JUP is trading at roughly $0.61, meaning that the Jupiter team stands to take away $100M in USDC as well as 50M JUP, worth another $33M, once the sale concludes on Feb. 6.

Some investors are alarmed by the Jupiter team’s plan to withdraw liquidity after the sale and move the proceeds to a team treasury.

“Does this mean we literally paid the dev 9 figures for free tokens? Was this a sort of hidden type of fundraising/ICO?” wrote X user Lord Ashdrake.

The pseudonymous Bighead, a trader focused on Solana, thinks the communication around LFG could have been better but that all the information was public. “The team shared this info before, but they could have done better explaining it, as Meow has admitted,” Bighead told The Defiant.

The team also took some heat for paying LFG a launchpad fee of 100M JUP. Founder Meow said on X that 75% of that will go to a decentralized autonomous organization (DAO) for Jupiter, and 25% will go to the project’s team.

Launchpad Mechanics

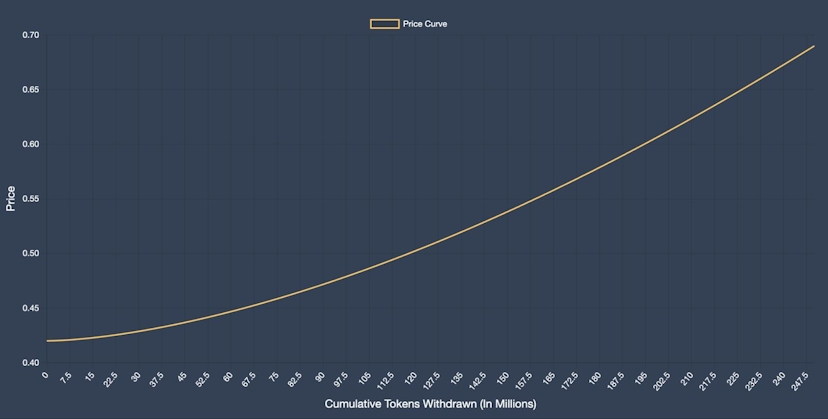

People are able to trade USDC for JUP and vice versa along a predetermined price curve between $0.40 and $0.69.

If JUP drops below $0.40, the pool would consist of 250M of the newly minted token and no USDC. At a price above $0.69, the pool would contain $131M USDC and no JUP, according to a chart provided by Jupiter.

The pool is open for seven days since Jupiter airdropped another 1B of its JUP tokens on Jan. 31. Whatever is left in the pool, whether it’s USDC or JUP or a mix, will go to the Jupiter team.

Meow, Jupiter’s colorful founder, has said on X that there won’t be any additional sales after the seven-day period.

The founder has also emphasized that the team did not raise funding from private investors. This is a common practice in crypto which some consider to be predatory as those investors are sometimes able to buy rights to tokens at lower levels than the digital assets ever hit on the open market.

Meow also explained that users can sell their airdropped JUP into the LFG pool if they want to during the seven-day period. “The point is to have a pool for buffering airdrops,” he said on the social media platform.

Jupiter’s website does not provide a press email, and The Defiant did not receive responses to multiple attempts to message team members on Discord to ask about LFG.

Meow did, however, respond to a message from The Defiant asking about the tokens from LFG by saying, “hehe, I got an idea for a chad move.”

The founder went on to talk about JUP gaining in value and generally rallied an extremely active Discord server.

Future Airdrops

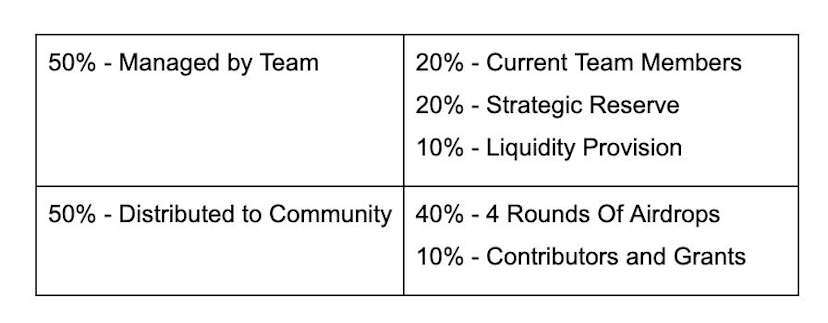

Moving forward, the Jupiter community can look forward to three more rounds of airdrops, according to a graphic Meow posted on X. The 20% of supply reserved for team members will start vesting over a two-year period in February 2025.

Regardless of whether the criticism directed towards Jupiter is merited, the JUP token is currently among the most-discussed digital assets in crypto circles.

Advertisement

The Defiant Daily

“an industry must-read”

Get an edge in Crypto with our free daily newsletter

Know what matters in Crypto and Web3 with The Defiant Daily newsletter, Mon to Fri

90k+ Defiers informed every day. Unsubscribe anytime.