Ether Dives 10% As Powell Signals More Rate Hikes To Come

Majority Of Investors Now Expect A 0.75% Increase In September

By: Aleksandar Gilbert • Loading...

Markets

Hinting at another sharp interest rate hike in September, Federal Reserve Chairman Jerome Powell sent crypto markets tumbling Friday.

As of 11 p.m. UTC, Ether has suffered the steepest decline among popular cryptocurrencies, having fallen more than 10% in the preceding 24 hours, according to data from The Defiant Terminal.

Solana also dropped 10%, while Bitcoin, Cardano (ADA) and Binance (BNB) each fell 6%.

Crypto Prices. Source: The Defiant Terminal

Data from July showed inflation easing somewhat in the United States. The closely-watched consumer price index was unchanged in July, and annual inflation dropped to 8.5% from 9.1% in June, which was a 40-year high.

Nevertheless, one month’s good news was not sufficient to proclaim the Fed’s mission accomplished, Powell said during his brief but highly anticipated speech at Wyoming’s annual Jackson Hole symposium on Friday.

Hawkish Stance

“Restoring price stability will likely require maintaining a restrictive policy stance for some time,” Powell said. “The historical record cautions strongly against prematurely loosening policy.”

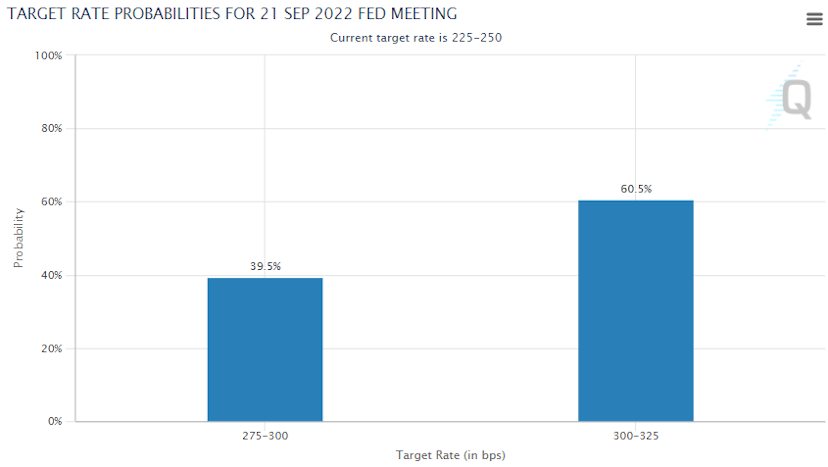

A majority of investors now think the Fed will raise interest rates by 75 basis points for the third straight meeting.

Just over half of investors last week were betting the Fed would raise interest rates by 50 basis points at its September meeting. Now, over 60% of investors believe the Fed will raise rates by 75 basis points, according to Federal funds futures tracked by CME Group.

‘Some Pain’

Powell warned that taming inflation would mean throwing water on an economy that has been running too hot since the world began to reemerge from the depths of the pandemic.

“While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses,” he said.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.