The Math Behind a Deflationary ETH After EIP-1559

There’s a bullish case for ETH, and it’s being defined by terms such as ultrasound money, triple-halving, and deflationary asset. Ethereum’s London hard fork is set to execute on August 5 and the included EIP-1559 upgrade has been hailed by many as a game changer for the world’s second largest cryptocurrency. Because the upgrade sets…

By: yyctrader • Loading...

DeFi

There’s a bullish case for ETH, and it’s being defined by terms such as ultrasound money, triple-halving, and deflationary asset.

Ethereum’s London hard fork is set to execute on August 5 and the included EIP-1559 upgrade has been hailed by many as a game changer for the world’s second largest cryptocurrency. Because the upgrade sets a base transaction fee that gets burned by the protocol, some are saying that ETH will now be deflationary, meaning there will be fewer tokens on the market, which could push the price of ETH up.

While it’s a compelling argument, investors should be aware that these are actually long-term structural changes to the network and the effects are unpredictable.

The Road To Deflation

Ethereum is currently an inflationary asset, implying that the total supply of ETH increases over time. Miners receive two freshly issued ETH as a reward for every block they mine. In addition, they also earn the gas fees paid by users of the network (ignoring uncle rewards here for the sake of simplicity).

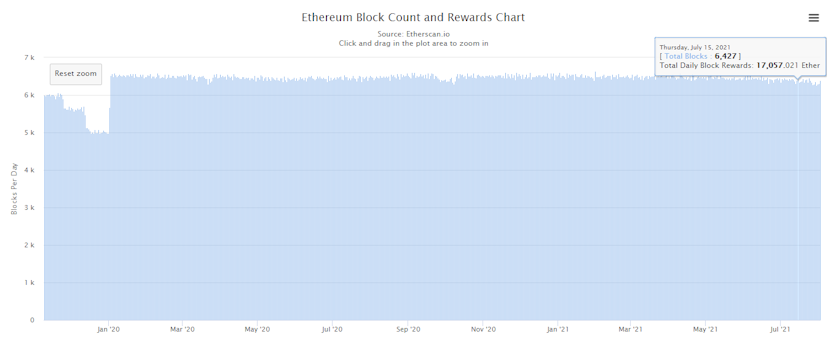

Over the last 18 months, the daily issuance of ETH has averaged around 17K ETH per day, as shown in the chart below from Etherscan.

Of this, 13K ETH can be attributed to miner block rewards (2 ETH per block times 6,500 blocks per day). The remainder consists mostly of transaction fees paid by users to make sure their transaction gets included in the next block.

No More Gas Wars

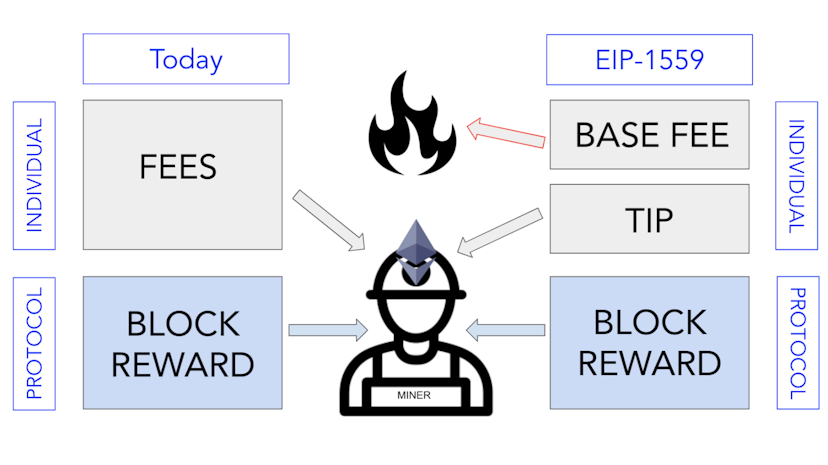

Image from ConsenSys

Once EIP-1559 is implemented at block 12,965,000, a portion of the gas fees paid by users will be burned, thereby permanently reducing the supply of ETH.

The rationale here is that transitioning to a flat base fee for each block will provide network users with more predictable gas fees by eliminating the gas wars that currently take place with the auction process. The base fee for a block is determined by an algorithm based on the gas used in the previous (or parent) block. Miners are no longer incentivized to pick transactions with the highest gas fees, since they won’t be receiving those fees anyway. And users will still be able to prioritize their transactions by offering a tip, which is an optional fee on top of the base fee.

When the network is congested, the block size is increased to accommodate more transactions in each block.

Above the Threshold?

EIP-1559 upgrades Ethereum’s gas pricing mechanism, but the underlying Proof-of-Work consensus mechanism will remain unchanged until Ethereum 2.0 is formally launched in a few months.

This means that miners will continue to earn block rewards as they do now, but the overall amount of ETH released daily into the market will be lower due to the burned fees.

Here’s where things get tricky as we cross into the realm of guesstimation.

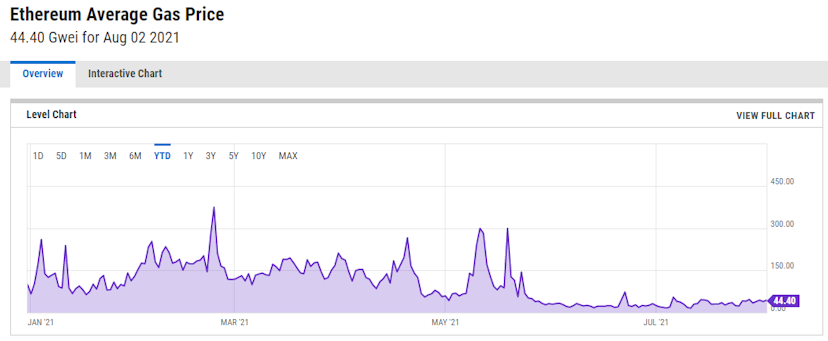

For ETH to be considered immediately deflationary post-1559, daily fee burns need to exceed the daily rewards paid out to miners. At current levels of network activity, that would require gas fees to remain above 150 gwei on a sustained basis, according to this handy simulator.

Since the advent of cheaper DeFi options like Binance Smart Chain and Polygon, we really haven’t seen Ethereum gas fees at those levels, except during specific NFT drops. So, we would need to see a dramatic increase in activity for gas fees to reach those levels on a sustained basis.

It’s certainly possible if the explosive growth of DeFi, NFTs and blockchain gaming continues, but it isn’t guaranteed.

So, while EIP-1559 is a major upgrade for Ethereum and the predictability of gas fees promises to improve the user experience, don’t rush to hitch your wagon to the deflation horse just yet.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.