Nearly 70% of Base Is Used By Project of ‘Questionable’ Utility

XEN is monopolizing most of the network’s resources, as it did in October 2022 on Ethereum.

By: Pedro Solimano • Loading...

Blockchains

A small project with a $28 million market cap is devouring Base’s network resources.

Storm Slivkoff, data associate for Paradigm Capital, reported the findings on April 12, explaining that

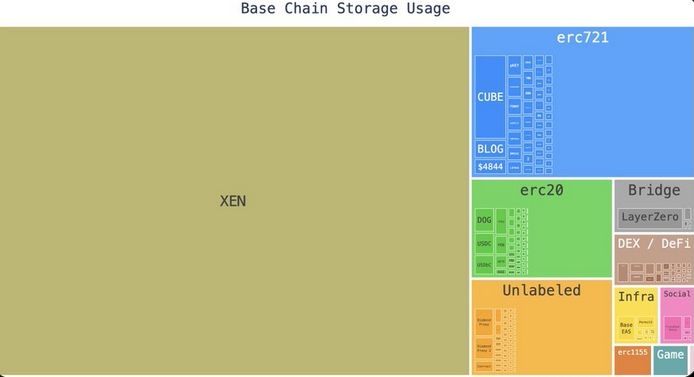

Nearly 70% of the state of Coinbase’s Layer 2 network Base, is being monopolized by 0.3% of its users, Storm Slivkoff, data associate for Paradigm Capital, reported Friday. In the context of blockchains, state refers to the status of all the data recorded onchain, including account balances, smart contracts, ownership records, and transaction status.

“~68% of Base chain state has been taken over by a single protocol of questionable utility,” he posted on X. “Thanks to cheap fees + storage mispricing, a tiny number of users have monopolized the majority of network resources.”

XEN has a market capitalization of $28 million, landing barely within the top 1,000 on Coingecko. It trades for $0.0000003 on a handful of smaller exchanges, the largest being Bitget.

The project is a virtual mining platform in which users can mint XEN and XENFT tokens on a variety of networks, such as Base. Since it has no threshold for minting, users have been taking advantage of Base’s low fees, and minting new XEN and XENFT tokens in droves.

According to Slivkoff, this has implications for every cheap fee blockchain.

When cheap computational resources are combined with speculation, resources will be used in unintended ways, he said, lumping Solana’s ORE, blobscriptions and gas tokens into this category.

But the problem is decreasing, he said, as XEN’s overall state share of Base peaked in October last year at 85%.

XEN on Ethereum

This isn’t the first time XEN makes its way into the headlines for spamming blockchains.

In October 2022, Ethereum turned deflationary for the first time as XEN pushed up gas prices by more than 40%.

When many people transact on Ethereum at the same time it drives up gas prices. Parts of the ETH-denominated transaction fees are burned, or permanently taken out of supply, because of another major upgrade, EIP-1559.

On that occasion, XEN’s smart contract began guzzling gas, spiking fees and pushing the network to drop supply by 2,000 tokens.

Nowadays, according to Slivkoff, XEN is the largest contract on Ethereum, responsible for 8.8% of all the network’s state chain growth, taking up 3.5% of all state chain as of writing.

XEN remains a somewhat mysterious project, touted for its complex mechanics.

According to its founder Jack Levin, countering the metrics on Coingecko, the project has a $56 million fully diluted valuation, and has 500,000 wallets. It offers a plethora of features, including no admin keys, 12 EVM-compatible chains and Bitcoin, and liquid staking.

In light of XEN, and the possibility that this happens across chains, Slivkoff recommends one direction: repricing storage.

But that comes with issues, he explained. “Once you pay for storage, that data gets stored by the network *forever* so it's like pricing a lifetime subscription.”

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.